NOAA has announced that forecasters have predicted above-normal hurricane activity in the Atlantic basin this year. Find out more and read the full press release here! Read a recent article from the Washington Post.

🔶🔶Flooding is a temporary overflow of water onto land that is normally dry. It is the most common natural disaster in the U.S. Failing to evacuate flooded areas, entering flood waters, or remaining after a flood has passed can result in injury or death. It is important that you take flooding seriously and know the facts. To learn more about how to prepare yourself and your family for flooding follow this link.

Prepare for Hurricanes and Summer Storms

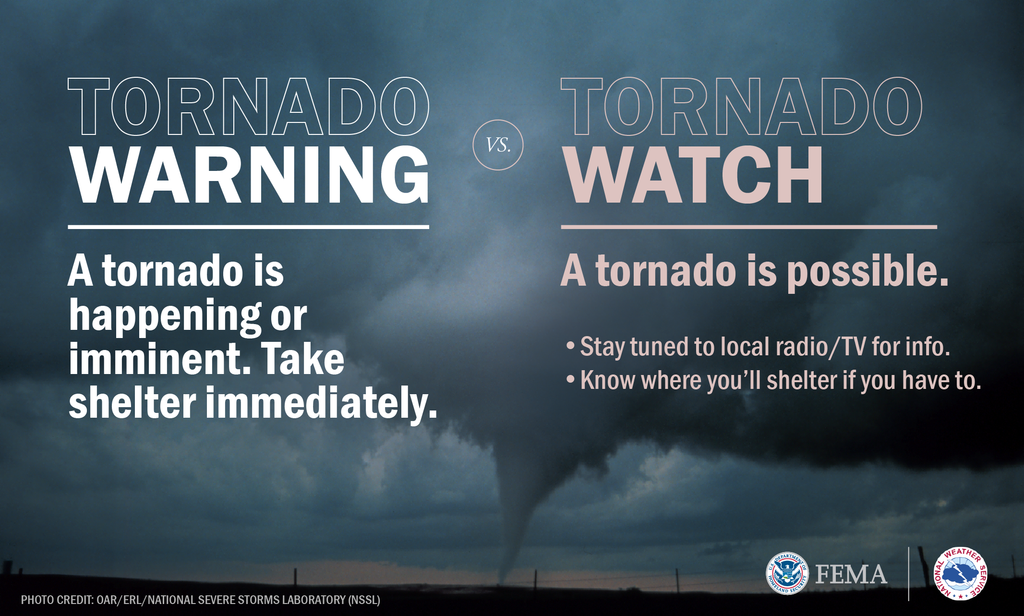

For many, warm weather means enjoying the outdoors with picnics, swimming and gardening. But summer isn’t always a day at the beach. As temperatures increase, so do the chances for thunderstorms and hurricanes. Although hurricane season began in May, late summer and early fall are when we typically experience the most hurricanes as ocean waters warm. Remember, hurricanes are not just a coastal problem, so it’s important to know the risks where you live since rain, wind and flooding could happen far from the coast. No matter where you live, thunderstorms can also be a threat. Lightning injures 243 people and kills about 20 people on average each year in the United States (see Weather.gov for more information). Heavy rain from thunderstorms can lead to flash floods and power outages. In addition, tornadoes can form during some thunderstorms. For many, warm weather means enjoying the outdoors with picnics, swimming and gardening. But summer isn’t always a day at the beach. As temperatures increase, so do the chances for thunderstorms and hurricanes. Although hurricane season began in May, late summer and early fall are when we typically experience the most hurricanes as ocean waters warm. Remember, hurricanes are not just a coastal problem, so it’s important to know the risks where you live since rain, wind and flooding could happen far from the coast. No matter where you live, thunderstorms can also be a threat. Lightning injures 243 people and kills about 20 people on average each year in the United States (see Weather.gov for more information). Heavy rain from thunderstorms can lead to flash floods and power outages. In addition, tornadoes can form during some thunderstorms.Here are some tips to prepare for storms this summer: For all storms Download the free FEMA app to receive real-time alerts from the National Weather Service and to stay informed about watches and warnings. You can also sign up to receive Emergency Alerts in your area. Make an emergency plan. Be sure to have extra water and nonperishable foods at home. Get started by having enough supplies for your household, including medication, disinfectants and pet supplies. Make sure you consider your family’s unique needs, including anyone who needs medicine or medical equipment. If there’s a chance you will need to evacuate, create a smaller “go bag” to take with you or keep in the trunk of your vehicle. Remember that after certain severe weather events like a hurricane or tornado, you may not be able to buy some essential items for days or even weeks. Hurricanes Know your risk for hurricanes and take action to prepare by visiting FEMA’s Protective Actions Research website. Hurricanes are not just a coastal concern. Rain, wind, flooding and even tornadoes can strike far inland from where a hurricane or tropical storm makes landfall. If you live in an area that’s affected by hurricanes, practice your evacuation route with household members and pets, and identify where you will stay. Local emergency managers can provide the latest recommendations based on the threat to your community. Make sure to clear storm drains and gutters and bring outside furniture indoors. Consider installing hurricane shutters if you need added protection against the storm. Thunderstorms Be prepared for thunderstorm, lightning and hail by planning to move inside a sturdy building or a metal vehicle with a roof. Remember the saying, “When thunder roars, go indoors.” Moving under a tree to stay dry is especially dangerous because lightning often strikes the tallest object in its path. There is no safe space outdoors. If you are caught outside with no safe shelter anywhere nearby the following actions may reduce your risk: Immediately get off elevated areas such as hills, mountain ridges or peaks. Never lie flat on the ground. Never shelter under an isolated tree. Never use a cliff or rocky overhang for shelter. Immediately get out and away from ponds, lakes and other bodies of water. Stay away from objects that conduct electricity (barbed wire fences, power lines, windmills, etc.). Unplug appliances and plan to avoid running water or using landline phones. Electricity from lightning can travel through plumbing and phone lines. Stay off corded phones, computers and other electrical equipment that put you in direct contact with electricity. Avoid plumbing, including sinks, baths and faucets. Stay away from windows and doors, and stay off porches. Do not lie on concrete floors, and do not lean against concrete walls. Tornadoes Be prepared for a tornado by understanding that they can happen anytime, anywhere so it’s important to know where to stay safe. If a tornado warning is issued for your area, immediately find a place such as a basement or storm cellar where you can safely shelter in place. If you can’t find a basement or storm cellar, locate a small, interior room on the lowest level where you are, and shelter there until it is safe to come out of your shelter location. If you are outside and can’t get to a sturdy building, do not shelter under an overpass or bridge. You’re safer in a low, flat location. Use your arms to protect your head and neck. Watch out for flying debris that can cause injury or death. |

🔶🔶 As part of an effort to protect communities from floods and build resilience in the face of the climate crisis, the White House has launched a draft (or beta) version of a new website and mapping tool that will help users to search an address to determine if that location is in a high flood risk area. The Federal Flood Standard Support Website and Tool will help users implement the Federal Flood Risk Management Standard (FFRMS). The FFRMS applies to projects where federal funds are used for new construction, substantial improvement, or repairs to address substantial damage. This can include projects such as critical infrastructure, affordable housing developments, renewable energy, or broadband internet projects. The Tool will help users seeking federal funding for such projects to determine if they will be located within an area with increased risk of flooding. As the team seeks to develop future versions of the tool, they are looking to gather input and feedback from the public to improve the tool’s functionality. Learn more.

🔶🔶The Centers for Disease Control and Prevention (CDC) works to reduce harm and protect lives by helping communities prepare for, respond to, and recover from emergencies. Floods, big or small, can be devastating. Click here to learn what you can do to stay safe and protect your health from the dangers of flooding.

🔶🔶 Our partners at Medicare remind us that it is a good idea to be prepared in case a natural disaster strikes. Learn More about how to get the care you need if an emergency is declared.

🔶🔶 In recent years, weather-related disasters have grown more frequent and intense and the climate more variable. These trends have greater and longer-lasting effects on some populations than others. Work in disaster behavioral health (DBH) now includes accounting for climate-related disasters and related issues, such as disparities, geographic vulnerabilities, and climatological trends. Therefore, SAMHSA has released the Supplemental Research Bulletin — Climate Change and Behavioral Health, which reviews the mental health and substance use-related (behavioral health) effects of climate-related disasters on individuals and communities. It explores the connections between extreme weather and behavioral health issues and conditions and ways to foster resilience in impacted communities.

🔶🔶FEMA has produced Updates to FEMA Programs for People with Disabilities. Learn more.

🔶🔶 Click here for the latest map of the FEMA Regions, annotated with the names of the FEMA Voluntary Organization Liaisons in each region.

🔶🔶 For the latest FEMA VAL updates and VAC Snapshot Reports (distributed every Friday) go to VOISE Dashboard. Go to the FEMA VAL Donations Unit Dashboard for donation offers and needs. You can sign up for FEMA reminders and operational updates by sending an email to [email protected].

🔶🔶Reforming FEMA’s Individual Assistance. On March 22, FEMA enacted the most significant update to survivor assistance in the last 20 years to reach more survivors and deliver assistance faster. With these updates, survivors of disasters declared on or after March 22 will have access to a wider range of assistance that is easier to understand and tailored to their unique needs. People impacted by disasters declared before March 22 will continue receiving FEMA’s full support to recover and rebuild. The updated survivor assistance benefits only apply to new disasters declared on or after March 22 and underscore the agency’s ongoing commitment to putting people first. The date of declaration for each federally declared disaster can be found on FEMA.gov. The presentation slide deck of the training is linked here for your reference. Feel free to share these with others. Also, please see the VAL Snapshot Report #288, which contains valuable links on the first page to more information around the regulatory changes. Here is a one-page description of some of the major changes. The Disaster Housing Recovery Coalition (DHRC) held a webinar recently to address the disaster recovery reforms recently announced by FEMA. A recording of the webinar, as well as slides, are available.

As FEMA continues large-scale reforms, they are looking to modernize across multiple workstreams. FEMA is optimizing and evolving the current Disaster Case Management program, to provide case managers and survivors with the service they need and deserve. To achieve these objectives, FEMA has issued a Request for Information (RFI) from case management and emergency management professionals regarding barriers associated with FEMA’s current DCM program, best practices for providing post-disaster case management services, and innovative solutions. The deadline to submit information is July 25, 2024, at 05:00 pm, ET. Read More About the RFI.

🔶🔶Learn how you can better prepare yourself and your community through articles, Data Digests, and other news curated by FEMA’s Individual and Community Preparedness Division (ICPD).

🔶🔶 A new online educational game designed to teach high school students about decision making during disasters is now available! Disaster Mind challenges and encourages participants to make critical decisions in the face of three simulated disaster scenarios: a flood, a wildfire and a blizzard. Complicating their quest, a mysterious guide creates challenges for the participants during game play. See also the supporting educational materials.

FEMA Releases Prepare with Pedro Storybooks

FEMA, in collaboration with the American Red Cross, is excited to announce an expansion of the Prepare with Pedro suite of activities. Three hazard-specific storybooks, focusing on Extreme Heat, Wildfire and Hurricane preparedness are now available. In these storybooks, Pedro the Penguin goes on adventures and learns what to do before, during and after each emergency. The storybooks are available in English and Spanish and can be ordered from the FEMA Warehouse or downloaded from the Prepare with Pedro website on Ready.gov. The Wildfire storybook is available online and will be ready to order from the warehouse soon. These storybooks join other fun Pedro products, like the Prepare with Pedro Activity Book and the Adventure in Emergency Preparedness matching game. Additional storybooks will be released later this year. Be sure to check the Prepare with Pedro website for new updates and releases. FEMA, in collaboration with the American Red Cross, is excited to announce an expansion of the Prepare with Pedro suite of activities. Three hazard-specific storybooks, focusing on Extreme Heat, Wildfire and Hurricane preparedness are now available. In these storybooks, Pedro the Penguin goes on adventures and learns what to do before, during and after each emergency. The storybooks are available in English and Spanish and can be ordered from the FEMA Warehouse or downloaded from the Prepare with Pedro website on Ready.gov. The Wildfire storybook is available online and will be ready to order from the warehouse soon. These storybooks join other fun Pedro products, like the Prepare with Pedro Activity Book and the Adventure in Emergency Preparedness matching game. Additional storybooks will be released later this year. Be sure to check the Prepare with Pedro website for new updates and releases. |

🔶🔶 FEMA produces hazard information sheets, which are short, two-page summaries of research-based guidance and advice for actions you should take to prepare for, protect against and recover from specific disasters or hazards. As hurricane season approaches, take time to understand and prepare for how a hurricane could affect you by downloading FEMA’s Hurricane Hazard Information Sheet. Because hurricanes and other weather related events can result in power outages, you should also prepare yourself and your family for the loss of power by downloading FEMA’s Power Outage Hazard Information Sheet.

🔶🔶 FEMA has released the “Climate Adaptation Planning: Guidance for Emergency Managers.” The guide helps emergency managers incorporate climate adaptation into planning efforts and the structure is designed to walk state, local, tribal, and territorial partners through the Six Step Planning Process, as identified in “Comprehensive Preparedness Guide 101: Developing and Maintaining Emergency Operations Plans.”

🔶🔶 Many adults are caregivers for someone who has a disability, has special healthcare needs, or is older. Caregivers are often family members or friends who provide emotional support, companionship, and help with routine tasks. Although everyone needs to be prepared for disasters, caregivers need to prepare both themselves and their care recipient. Learn more and review tips from the CDC’s EPIC Exchange.

🔶🔶 The Department of Homeland Security has unique career opportunities to help secure our borders, airports, seaports, and waterways; research and develop the latest security technologies; respond to natural disasters or terrorists’ assaults; and analyze intelligence reports. Learn more at Homeland Security Careers | Homeland Security (dhs.gov).

🔶🔶 Need to contact a government agency? The A-Z list provides the contact information for federal agencies, departments, and offices in one convenient location so you can quickly find:

- Websites

- Emails

- Phone numbers

- Mailing addresses

Find Contact Information for Federal Agencies

🔶🔶 FEMA and the Rosalynn Carter Institute for Caregivers (RCI) have created the Disaster Preparedness Guide for Caregivers to help them navigate unique challenges that may arise during disasters. While caregiving can be overwhelming at times, taking three essential steps—assessing needs, engaging a support network, and creating a plan—can help caregivers feel more prepared and in control when disaster strikes. The Disaster Preparedness Guide for Caregivers includes tailored information and resources for three main caregiver audiences: those who can involve their care recipient in their planning, those who can engage a support network to aid planning, and solo caregivers. It provides key considerations caregivers can use to identify their care recipient’s needs and how they may change during a disaster.

🔶🔶 The Association of State Floodplain Managers’ flood mitigation resource library continues to work to bring flood mitigation to the masses with the addition of 22 things property owners can do to reduce flood risk, just in time for many state severe weather awareness campaigns. The new strategies range from relatively simple projects, like landscaping and plumbing improvements, to more complex engineering options, such as constructing an earthen levee or installing underground water tanks. As you work with home and business owners looking to make informed decisions around the action they can take this year to lower their risk of flooding, let them know about the Reduce Flood Risk website. Developed by ASFPM with financial support from FEMA, this interactive website demystifies flood mitigation and empowers people to protect themselves and their assets. To learn more follow this link.

🔶🔶 John A. Miller, FEMA Region 2 Mitigation Liaison, has written an article, “Worried About Extreme Weather? – You Are Not Alone”. He writes, “According to a recently released survey by LendingTree of nearly 2,000 consumers, about half are fearful of climate change-related hazards effects on their homes, with severe storms making up a quarter of the hazards of worry. Worry is not only based in personal safety and physical impacts. A quarter of respondents were concerned about reduced property value in the next ten years, while seven in ten think the increasing risk will make insurance more expensive (20% say they have already experienced in increase), with more than a third worried they will be dropped by their home insurer.” READ FULL ARTICLE

🔶🔶 FEMA and the National Endowment of the Arts proudly announces the release of the Fact Sheet on Art and Culture: Helping People Before, During, and After Disasters. This fact sheet adds to ongoing conversations about how individual artists and the art community at-large can lend their vision and skills to build communities more resilient to disasters which we covered on FEMA and NEA’s Webinar on Disaster Resources for Artists and Art and Cultural Institutions (youtube.com) Feel free to also check out Inspiration Book: Arts and Experiential Learning (fema.gov) and Guide to Expanding Mitigation: Making the Connection with Arts and Culture (fema.gov).

🔶🔶 National Emergency Management Basic Academy is providing Training Opportunity 1853 at the DC Homeland Security and Emergency Management Agency, Washington, DC, over 5 weeks in August, September, and October, 2024. The National Emergency Management Basic Academy is designed for individuals pursuing a career in emergency management and provides a foundational education in emergency management knowledge, skills, and abilities.

🔶🔶 A study, conducted by Dr. Josh DeVincenzo, investigates how climate change education can meet the learning needs of U.S. emergency management (EM) professionals. The study focuses on understanding EM’s experiences and learning processes regarding climate change impacts by leveraging the expertise of certified emergency management professionals as key informants. The findings reveal an increasing recognition among U.S. emergency managers of the complex impacts of climate change on their roles. They expressed a preference for localized climate information considering cognitive, social, political, and historical dimensions, and emphasized practical, long-term thinking-oriented climate training. The study identified strong motivation, preparation for future learning, and a sense of purpose among emergency managers, suggesting the potential integration of climate change information into existing emergency management frameworks. Emergency managers stressed the need to refine roles and foster collaboration across sectors to address climate change effectively, acknowledging resource limitations. Despite challenges, the study highlighted the potential for climate literacy to transcend personal, professional, and sectoral boundaries, providing insights for shaping future training programs and guiding researchers and practitioners to engage with the emergency management community. Read the full research study.

🔶🔶The Climate Risk and Resilience Portal (ClimRR) is a free, national online source for sophisticated climate data down to the neighborhood level. ClimRR provides easy access to climate data to integrate future conditions into Hazard Mitigation Plans, land use plans, infrastructure design, and FEMA’s Resilience Analysis and Planning Tool (RAPT). ClimRR data is available for changing hazards: extreme temperatures (hot and cold), cooling and heating degree days, heat index, wind, fire weather index, precipitation/no precipitation under two carbon emission scenarios. The updated portal lets users visualize and analyze future climate hazards combined with local demographic and infrastructure data. Enhanced features include:

- New Consolidated Local Reports Assessing Future Climate Hazards and Community Impacts

- New Maps, Charts & Visualizations

- Improved Educational Features to Interpret Climate Hazard Data Points

Billion-Dollar Weather and Climate Disasters

The U.S. has sustained 360 weather and climate disasters since 1980 where overall damages/costs reached or exceeded $1 billion (including CPI adjustment to 2023). The total cost of these 360 events exceeds $2.570 trillion.

Read Full Article

====================================================================

SHIELDS READY CAMPAIGN

CISA’s Shields Ready campaign is about making resilience during incidents a reality by taking action before incidents occur. As a companion to CISA’s Shields Up initiative, Shields Ready drives action at the intersection of critical infrastructure resilience and national preparedness. By taking steps in advance of an incident, organizations, individuals, and communities are better positioned to quickly adjust their posture for heightened risk conditions, in turn helping to prevent incidents, to reduce impact, and get things back to normal—or better—as quickly as possible. Being part of the resilience journey makes for more resilient people, organizations, and communities.

=======================================================================================

Stay Connected with FEMA Disaster Operations

Click here for current FEMA disaster information.

Has Your FEMA Claim Been Denied

Learn more about FEMA Individual Assistance.

Doing Business with FEMA | FEMA.gov –

Learn about the four-step process your organization can follow to do business with FEMA, in accordance with the Robert T. Stafford Act.

SBA Office of Disaster Assistance

The Office of Disaster Assistance’s mission is to provide low-interest disaster loans to businesses of all sizes, private non-profit organizations, homeowners, and renters to repair or replace real estate, personal property, machinery & equipment, inventory and business assets that have been damaged or destroyed in a declared disaster.

Resources from the U.S. Small Business Administration:

Disaster Assistance Loans For Businesses and Non-Profit Organizations

Disaster Assistance Loans for Homeowners and Renters

What Houses of Worship Need to Know About the FEMA Disaster Aid Process

Various Tips and Tools from FEMA

++ Tools to Recover | FEMA.gov – FEMA has collected frequently used tools and information to help you communicate and get started with the recovery process.

++ Flood Safety Tool Kit – Flooding is the most common and costly disaster in the United States and can happen anywhere it rains. At any given time, floodwaters can cause millions of dollars in damage. This toolkit offers important information to prepare you for floods, prevent injury, loss of property, and even loss of life.

++ Frequently Asked Questions About Disasters – Get answers to frequently asked questions about emergency shelters, disaster assistance, flood insurance and more.

++ Disaster Multimedia Toolkit | FEMA.gov – The resources on this page are ideal for external partners and media looking for disaster recovery content to share on social media during and after a disaster, including: social graphics, flyers and announcer scripts, accessible videos and animations in multiple languages.

++ Disaster Text Messaging Resource Kit – Communication can be limited following a disaster. This resource kit offers text messaging information you can share with survivors when only text messaging is available in a service area.

++ FEMA in Your Language | FEMA.gov – Disaster survivors can find translated information about disaster assistance programs, emergency preparedness, response and recovery activities, and flood insurance. The information comes in various formats and is available for sharing and downloading. Additional resources will be added periodically, so please visit often.

++ Save Your Family Treasures | FEMA.gov – FEMA and the Smithsonian Institution co-sponsor the Heritage Emergency National Task Force, a partnership of more than 60 national service organizations and federal agencies created to protect cultural heritage from the damaging effects of natural disasters and other emergencies.

++ CDC colleagues have great safety material in multiple languages: Health and Safety Concerns for All Disasters|Natural Disasters and Severe Weather (cdc.gov)

FEMA’s National Flood Insurance Program:

How to Start Filing Your Claim

How to File a Flood Insurance Claim English | Spanish

Starting Your Recovery: FEMA’s Flood Insurance Claims Process English | Spanish

Wind vs. Water Damage English | Spanish

Below are resources available for your use. All resources may be shared with or distributed to other partners in insurance, public safety, emergency management, media and elsewhere.

Quick Resources

- Video: How to Secure Documents in Preparation for a Flood English | Spanish

- Video: How to Document Damage English | Spanish

- Flyer: How to Start a Flood Insurance Claim Flyer English | Spanish

- Flyer: Identifying Your Advocates After a Flood English| Spanish

Read More

To help people better understand the National Flood Insurance Program’s new methodology, FEMA published two videos in a series explaining rating variables and how they affect premiums. The first of these new videos, Risk Rating 2.0: Equity in Action: Rating Variables (Part 2) complements Risk Rating 2.0: Equity in Action: Rating Variables (Part 1). The new video describes how a structure’s location and the way it is built impact a policyholder’s premium. It also explains why certain building decisions can affect the final rate determination. The other new video details the nuances of building and content coverage.

Whether you’re a renter or a property owner, take a moment to consider adding flood insurance to your financial safety net. Bottom line: basic home and renters policies don’t cover flood repairs, but you can fill that protection gap. Not sure if you have flood risk? Take this quiz.

Home insurance prices are at an all-time high in many parts of the US today, but protecting your assets is still so important. If you’re not in a high flood risk area, adding that protection won’t be a budget buster. If you have an NFIP policy but are considering dropping it, make an informed decision before you do. The fact is – all states have some flood risk.

Flood insurance details:

- You can add flood coverage through a private flood insurer or the National Flood Insurance Program.

- There will be a waiting period from the date you buy it to the date it kicks in. (30 days for an NFIP policy).

- Flood insurance can be very affordable, depending on your location.

- Use this link to learn about your area’s flood risk, contact an insurance agent or call the NFIP at 877-336-2627.

- If you have a mortgage and your home is in a Special Hazard Flood Zone, your lender will require flood insurance.

- An NFIP policy provides $250,000 max to repair flood damage to your home.

- An NFIP policy provides $100,000 max for belongings but not automatically. You have to ask for and pay for this additional coverage.

- An NFIP policy will NOT cover temporary rent if your home is uninhabitable after a flood. Most private flood policies cover that expense.

Contact your insurance agent or company and ask:

- How much will it cost to insure my home and belongings for flood damage?

- Can you help me compare the cost, coverages, and options in an NFIP versus adding coverage to my existing policy through a “flood endorsement” or private flood insurer?

- Would a flood rider or endorsement give me more than $250,000 in coverage? Will it cover temporary rent?

The Pennsylvania Insurance Department (PID) has announced that Insurance Commissioner Michael Humphreys, as Chair of the Flood Insurance Premium Assistance Task Force (the Task Force), is seeking public input on the accessibility and affordability of flood insurance throughout the Commonwealth. The comment period will close on February 5, 2024. The Task Force will review and analyze existing statutes, procedures, practices, processes, and rules relating to the administration of flood insurance in Pennsylvania, and recommend potential programs that provide premium discounts, programs that incentivize local governments to support flood mitigation efforts, and how to increase the number of people who purchase flood insurance through the national flood insurance program or the private flood insurance marketplace. It was established by Act 22 of 2023. Public comment on flood insurance may be emailed to [email protected], or comments may be mailed to PID’s Director of Policy and Planning, Office of the Insurance Commissioner, 1326 Strawberry Square, Harrisburg, PA 17120. Comments are requested by February 5.

Pennsylvanians impacted by flooding should visit PID’s website for resources that can help guide property owners through filing insurance claims, and tips to avoid repair scams. More information on the NFIP and private flood insurance is available on the Insurance Department’s one-stop Flood Insurance page, and more information on guidance following a severe weather event can be found on the Disaster Recovery resource page.

Consumers with questions or wishing to file a complaint can contact PID’s Consumer Services Bureau by visiting its webpage, or by calling 1-877-881-6388.

——————————————————————————————————————————————-

FEMA has collected frequently used tools and information to help you communicate and get started with the recovery process. Go to https://www.fema.gov/disaster/recover.

——————————————————————————————————————————————

Short Videos:

- How a Disaster gets Declared – YouTube

- The Importance of Applying for SBA – YouTube

- Verifying Home Ownership or Occupancy – YouTube

- How to Save Your Family Treasures After a Disaster – YouTube

- FEMA Public Assistance for Houses of Worship – YouTube

- FEMA Accessible: Individuals and Households Program Disability Cap – YouTube

Key Infographics:

- Disaster Survivor Checklist Graphics | FEMA.gov

- Displaced From Your Rental Property Graphics | FEMA.gov

- What to Expect After You Apply for FEMA Disaster Assistance (In-Person Inspection) Graphics | FEMA.gov

- Beware of Fraud and Scams Graphics | FEMA.gov

- Common Reasons for Denial Graphics | FEMA.gov

- Civil Rights Graphics | FEMA.gov

- Difference Between Individual Assistance Versus Public Assistance Grant Programs Graphics | FEMA.gov

- Verifying Homeownership Occupancy Flyers | FEMA.gov

- How to Write An Appeal Graphics | FEMA.gov

- What Houses of Worship Need to Know About the FEMA Disaster Aid Process Flyer | FEMA.gov

————————————————————————————————————————————-